Tools for Context Analysis

What is a Context Analysis?

The purpose of a context analysis is to allow campaigners and NGOs to better understand the socio-cultural, political, economic and geographic factors at play. A structured context analysis can contribute to how you prioritize your work and plan your campaigns. It can also help in project design, implementation and the monitoring and evaluation framework.

Why do a Context Analysis?

The reasons for conducting a context analysis include:

- Campaign design and quality

- Informs campaign design in an inception phase

- Identifies the root causes and contributing factors to a social issue.

- Determines stakeholders’ positions, interests and influence

- Assesses campaign entry points for campaign themes

- Access

- Informs decisions on access

- Contributes to decisions on partner selection

- Contributes to decisions on provision of services

- Monitoring and evaluation

- Informs reassessments of campaign

- Contributes to monitoring and evaluation design

How to do a Context Analysis?

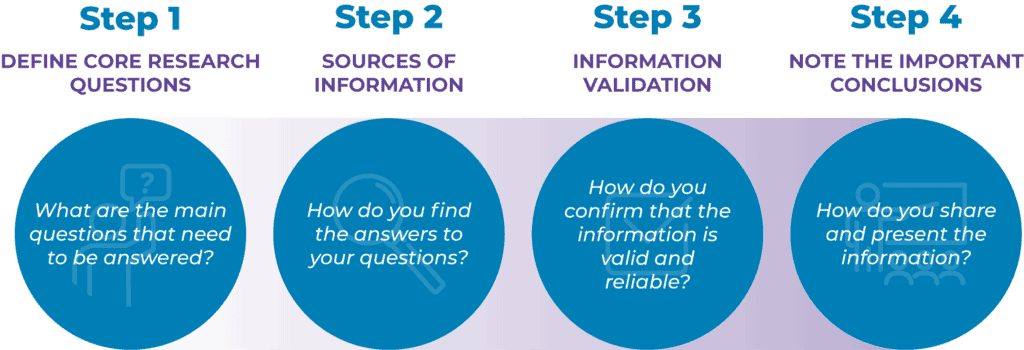

To collect the information needed, there are four steps to go through. The four steps are:

- Step 1. Define core research questions: What are the main questions that need to be answered?

- Step 2. Sources of information: Find the information in the best way

- Step 3. Information validation: Validate the information

- Step 4. Note the important conclusions: What’s relevant for your campaign.

Step 1: Define Core Research Questions

Start by defining the core questions and decide what information is needed. Here, specific issues and questions related to your campaign aim can be highlighted, as well as specific indicators that should be used, for example, the number of girls who get pregnant before the age of 18, the freedom index, and so on. Specific information can also be divided into different groups, such as gender, age, urban/rural, ethnicity, or religion.

Step 2: Sources of Information

Once you have identified your research questions, the next step is to determine how best you can find the answers to your questions. There are two main approaches:

- To use existing information (secondary data) from studies that have been conducted and published. This method is called desk research. Existing desk studies, reports and information. This includes information from expert organisations (such as IPPF, NDI, Amnesty International, Human Rights Watch, Freedom House), reports from reliable organisations as well as relevant statistical databases.

- To collect new information (primary data ) using methods like social listening, surveys, focus groups or interviews.

Secondary Data Collection

- Existing desk studies, reports and information. This includes information from expert organisations such as the IPPF, NDI, Amnesty International, Human Rights Watch, Freedom House or other reliable organisations as well as relevant statistical databases.

- If this is not enough, you may need additional information. Carrying out extensive surveys is not advisable, but topics for further desk research and possible sources to explore can be suggested.

Primary Data Collection

Depending on the objectives of the campaign, this is done through a mixed-method approach consisting of quantitative methods (surveys, statistical analysis) and qualitative methods (focus group discussions, interviews).

- Social listening: This is a method to analyse the discourse on social media of online publicly available platforms (for example, Twitter, news, forums, blogs, YouTube). Social media platforms are increasingly becoming a space for people to express their needs and opinions. Monitoring and analysing social media discourse can provide valuable insights for any organisation serving an audience. It provides a real-time approach to detect social developments that are discussed online.

- Focus groups: Often used to assess the needs of users prior to a project. Focus Groups can also be used to collect data on the results (primarily on the outcomes) of your project. This is especially useful to add depth to your qualitative data, for instance by asking members of the focus group to help explain why certain trends occur in the data.

- Interviews: Identify resource people to engage with and interview, such as reliable regional experts. When interviewing these experts, it is important to ask open questions, to explore these, and to consistently summarise and request proof of the statements.

- Surveys: You can efficiently find out about people’s opinions, experiences or attitudes on certain issues by using an online survey like Survalyzer, Microsoft Forms or Google Forms. People can also self-assess their learning or behaviour change (‘I gained new insights’), which is an easy but somewhat biased way to collect outcome data. Online surveys need to be planned carefully, as the response can otherwise be low. The response rate can be boosted through advertising and by offering (modest) prizes. Most survey management tools also offer standardized surveys for inspiration.

Step 3: Information Validation

Information is often biased, based on different perspectives, views or interests. So, it is essential to keep asking yourself “Is this information valid and reliable?” The information that is gathered may be disputed and contradicted so it needs to be validated. Once the information has been assembled, it must be critically reviewed in order to identify:

- Inconsistencies and contradictions between different sources. Resource people can be consulted to correct the inconsistencies. Alternatively, cite the information of the most reliable source. If they are equally reliable, quote both sources.

- Gaps in information. If possible, go back and consult the resource people again. If that is not an option, make intelligent assumptions: for instance, use information from comparable contexts (for example, a neighbouring country or the region).

- Pieces of information that seem unreliable. In these cases, seek additional information, for instance by consulting your resource people. Having a well-informed and knowledgeable network can be immensely helpful throughout your campaign.

Step 4: Note the Important Conclusions

Once you’ve gathered the necessary information, and validated it, the next step is to summarize the most important conclusions relevant to your campaign. What has the context analysis told you that’s new or surprising. Does it help you find the right audience for your campaign? Does it give you a benchmark against which you can judge success?

Canvas: What is the context you are operating in?

What are the different points of view on the issue? Write down the key results of your context analysis relevant to your campaign.